The Gender Pay Gap

No matter how you analyze it, the gender pay gap is real, persistent and harmful to women’s financial well-being.

Get the Facts - The Simple Truth 2025 Update

More Than a Paycheck

Women working full time in the U.S. are paid 83% of what men earn. At the current rate of change, we won’t achieve pay equality until 2088.

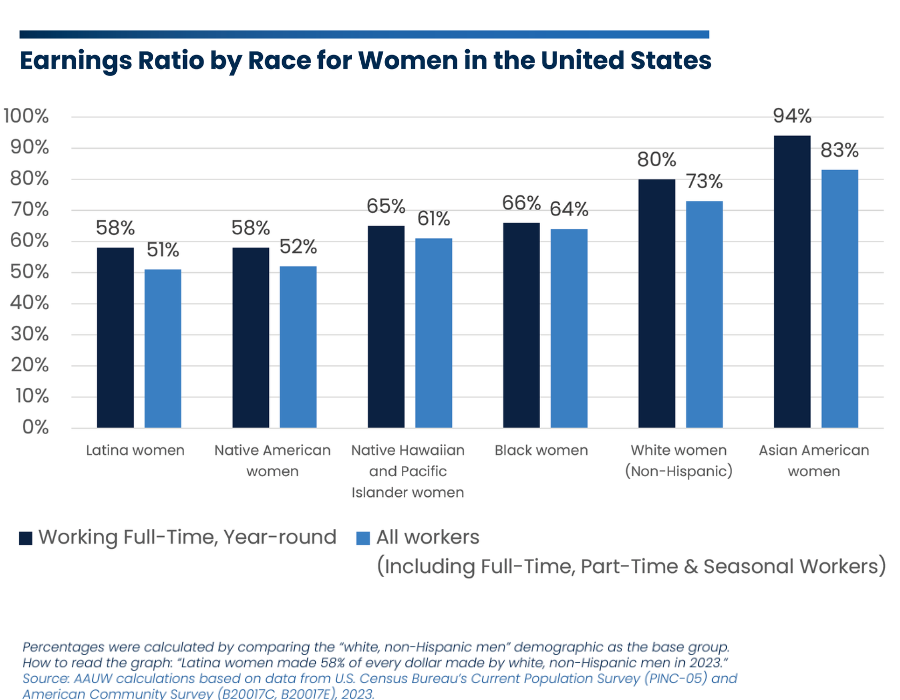

AAUW’s research shows that a gap exists at all levels of work in almost every occupation. There is a gender pay gap in every state. It cuts across all age groups and demographics, widening significantly for women of color. The gap greets a woman as soon as she gets out of college and grows wider throughout her lifetime.

What can we do?

Fighting for change

Unfortunately, there’s no magic bullet or quick fix. Though the status of women has dramatically improved in recent decades, the lingering inequity is the result of historical, societal and political legacies that persist today. Outdated norms about gender roles run deep in our culture: They affect the paths that girls and women pursue throughout their education; expectations about their roles as mothers and caregivers; laws, policies and legacies that favor men; and flat out discrimination, bias and misconduct that hinder women’s advancement. These all add up to an unacceptable reality that AAUW is fighting to change.

AAUW believes achieving pay equity requires a multi-pronged approach:

- Equal Pay Laws: Rigorous enforcement and strengthening of the Equal Pay Act, reinstatement of pay data collection by the U.S. Equal Employment Opportunity Commission (EEOC), and advancing state pay equity laws will go a long way to ensuring women, particularly women of color, are paid equitably. Policymakers should require employers to provide equal pay for jobs of equivalent value to help reduce the impact of occupational segregation.

- Higher Education Support: Reducing barriers to obtaining a degree will make higher education more affordable, increase earning potential, and lower risk of unemployment for women. Policymakers should protect and expand Pell Grants and Work Study programs for lower-income students, support income-driven student loan repayment options, and allow for expanded public service loan forgiveness programs.

- Paid Leave: Implementing paid family and medical leave initiatives will mitigate challenges faced by women who are disproportionately responsible for caregiving. Women being able to take paid time off when pregnant and taking care of family members or self without sacrificing their earnings will prolong their workforce participation, increase mental health benefits, increase loyalty towards their employers, and protect their social security retirement benefits.

- Childcare Access: Making high-quality childcare more affordable will increase women’s workforce participation, allowing families more income that can be used for other needs and future savings.

- Reproductive Health: Improving access to reproductive care such as contraceptives and abortion care will allow women to have more autonomy by increasing their ability to pursue higher education, participate fully in the labor force, and choose when or if they want to have children.

AAUW Partners with NSF on Advancing Pay Equity in Higher Education

Joining forces with AAUW, the NSF ADVANCE Partnership Project “Let’s Talk Money” takes aim at bringing gender equity to higher education compensation. Rooted in AAUW’s commitment to dismantling equity barriers for women and girls, “Let’s Talk Money” aims to expand knowledge of best practices for faculty pay to the higher education community by:

• Building understanding of university pay-practices and outcomes.

• Incorporating an equity lens into pay-decisions.

• Expanding productive conversations about pay.

• Improving communication of pay decisions.

Take Action

There are lots of ways to get involved with AAUW’s work to advance gender equity. Together, we can make a difference in the lives of women and girls.